Explore Our Wide Array of Mortgage Products: Designed for Flexibility and Success

We combine competitive rates, groundbreaking tools and technology, and a fast, easy process to help you deliver a worry-free mortgage experience.

This cash-out refinance option allows homeowners to access up to 89.99% LTV—without the burden of mortgage insurance. With simplified guidelines and competitive rates, it’s a smart solution for tapping into home equity.

This low-down-payment option is perfect for qualifying borrowers who meet income limits and want to keep more money in their pockets at closing. We contribute toward the down payment making homeownership more accessible than ever.

Home Possible® is a flexible alternative to FHA financing, ideal for first-time buyers, retirees, and low-to-moderate income borrowers. It offers low down payment options with broad property eligibility.

Designed for low-to-moderate income borrowers, HomeReady® offers affordable financing with flexible terms and reduced mortgage insurance. Ideal for first-time homebuyers or those refinancing with limited equity.

Qualify more first-time homebuyers with this 3% down payment solution.

Offer borrowers one seamless closing for both construction and permanent financing. With just one set of documents, one approval, and one down payment, your clients can build their dream home with confidence.

Our streamlined condo approval process makes getting to the closing table faster. Limited Review, AUS-approved files only require a minimal evaluation—no condo questionnaire needed.

Give your borrowers greater affordability with lower introductory rates through a variety of 5-, 7-, and 10-year ARM options. Whether it's a standard conforming loan or high balance, we’ve got a flexible ARM solution ready to fit.

Additional Feature:

Help more borrowers who may not qualify for conventional financing achieve the dream of homeownership.

Help more borrowers who may not qualify for conventional financing achieve the dream of homeownership.

Take your FHA borrowers to a new level with industry-leading government rates and pricing. This is the obvious choice for your top-tier clients.

The FHA 203(k) Loan is designed for homebuyers and homeowners looking to purchase or refinance a home that needs repairs or renovations.

Lending Heights' FHA Streamline program allows you to refinance your FHA borrower with no appraisal or AVM.

Give your FHA borrowers a lower rate option with our 3/1 and 5/1 Adjustable Rate Mortgages (ARMs).

A VA loan isn’t just a benefit — it’s a strategic advantage. At Lending Heights Mortgage, we offer an entire suite of VA programs designed to meet the unique needs of those who have served in the Armed Forces. Whether it’s 100% financing, refinancing, or flexible ARM options, our VA loan lineup delivers the competitive edge and simplicity your military clients deserve.

Deliver a streamlined new construction solution for eligible veterans with zero monthly payments during the build phase and up to 100% financing.

Lending Heights' VA Elite loans are designed for VA borrowers with higher FICO scores, offering industry-leading government rates and pricing.

Lending Heights' VA IRRRL program allows borrowers to take advantage of their VA benefits by refinancing their current VA loan into a lower interest rate with minimal hassle.

Give your VA borrowers a lower rate option with Lending Heights’ 3/1 and 5/1 Adjustable Rate Mortgages (ARMs).

Lending Heights USDA loans are a great option for borrowers seeking 100% financing in eligible rural areas. Recognized as a top-tier USDA lender, Lending Heights offers a smooth, efficient process to help you close on time — with direct access to underwriting and rapid turn times.

Lending Heights USDA loans are a great option for borrowers seeking 100% financing in eligible rural areas. Recognized as a top-tier USDA lender, Lending Heights offers a smooth, efficient process to help you close on time — with direct access to underwriting and rapid turn times.

Key Highlights:

Help rural homebuyers purchase and renovate with one convenient loan. This USDA-backed program finances both the home and eligible improvements under a single mortgage.

A jumbo loan is a mortgage designed for high-value homes that exceed conventional loan limits, offering flexible terms and competitive rates for qualified borrowers.

Designed for self-employed borrowers who prefer flexibility over traditional income documentation, our Bank Statement Fixed loan lets you qualify using 12 months of consecutive business or personal bank statements.

A Non-QM (Non-Qualified Mortgage) loan is a mortgage product that does not strictly conform to traditional lending guidelines, offering more flexible underwriting standards for borrowers with unique income situations or credit profiles, such as Jumbo, Bank Statement, and Investor Flex DSCR loans.

Our six fixed-rate jumbo products provide competitive pricing and unique options unavailable at most big banks. Designed for borrowers who need financing above conventional loan limits. These loans are ideal for high-value property purchases and offer competitive terms with flexible qualification options.

Bank Statement Loans are designed for self-employed borrowers who prefer to use bank deposits instead of traditional income documentation to qualify. This flexible program offers an alternative path to homeownership without needing tax returns.

Debt Service Coverage Ratio or DSCR loans are for borrowers to qualify for loans on the market rent of their investment property, rather than their personal income. No income varification!

This flexible lending solution is designed for self-employed borrowers and non-U.S. citizens. Whether you're an independent contractor using 1099 income or an ITIN holder without a Social Security number, this program offers simplified documentation and inclusive access to home financing—no tax returns or W-2s required.

Subject to first lien restrictions. Not eligible in Tennessee (primary loans only) and Texas.

Not eligible in Iowa, Tennessee (primary loans only), Texas, and Vermont.

Not eligible in Iowa, Tennessee (primary loans only), Texas, and Vermont.

Originate our Investor Flex loans in 35 states, even without a license in those states: AL, AK, AR, CO, CT, DE, GA, HI, IL, IN, IA, KS, KY, LA, ME, MD, MA, MS, MO, MT, NE, NH, NM, OH, OK, PA, RI, SC, TX, VA, WA, DC, WV, WI, WY

Built for experienced real estate investors, the Investor Flex Fixed loan offers a powerful, flexible financing solution for scaling rental portfolios. With loan amounts up to $3 million, DSCR requirements as low as 0.00, and the ability to close in an LLC, this program supports both growing and seasoned investors—whether financing one property or twenty.

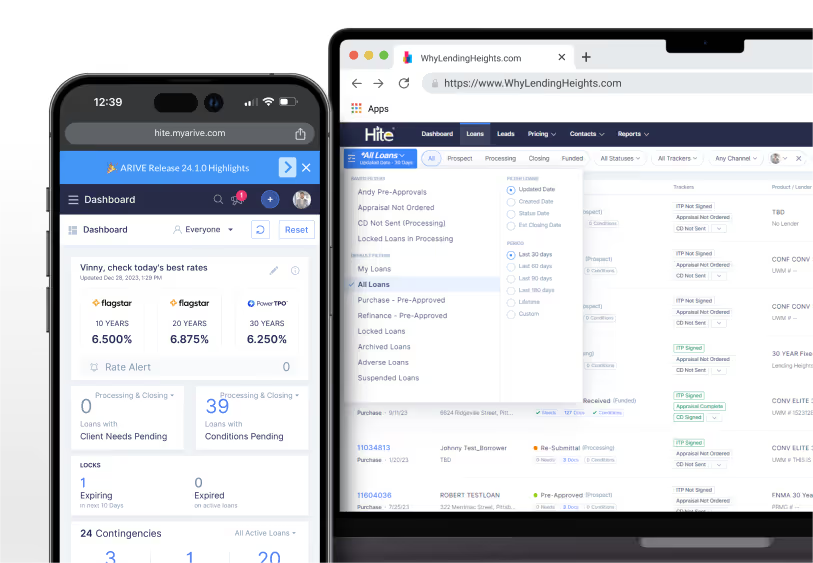

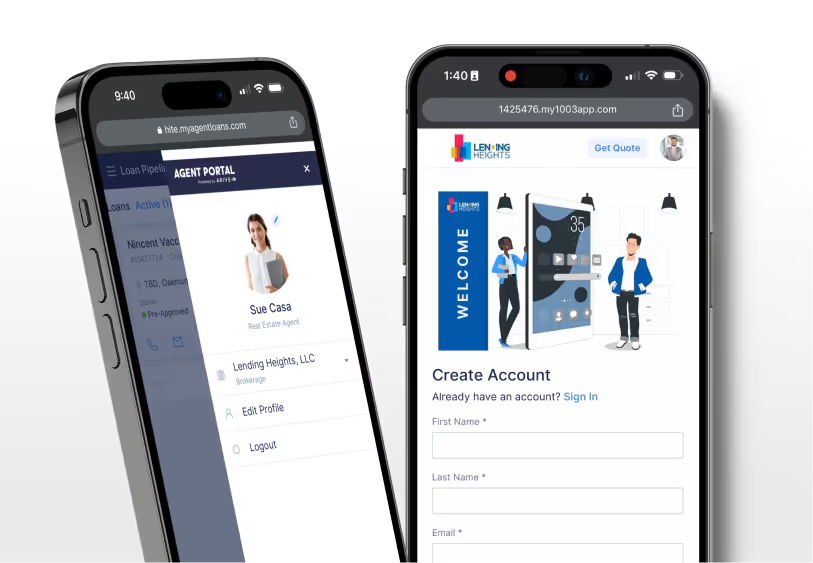

Meet your new superpower—Hite. Our all-in-one, web-based platform gives you total control and flexibility to manage loans seamlessly from any device, anywhere. With Hite, you’ll have access to a vast lender marketplace, real-time pricing, an intuitive CRM, and a streamlined POS that makes the client experience effortless. Designed for speed and simplicity, Hite empowers you to originate, communicate, and close with maximum efficiency—because you deserve a platform that works as hard as you do.

Our Loan Origination System is fully web-based, giving you the flexibility to originate and manage loans from anywhere—whether you’re at your desk or on the go with your mobile device. This tool empowers Loan Officers to efficiently meet client needs from any location.

Our POS system enhances the client experience with a seamless online application process, secure document upload, and real-time status tracking. Mobile-friendly and easy to use, it helps LOs capture leads and move them through the pipeline with ease.

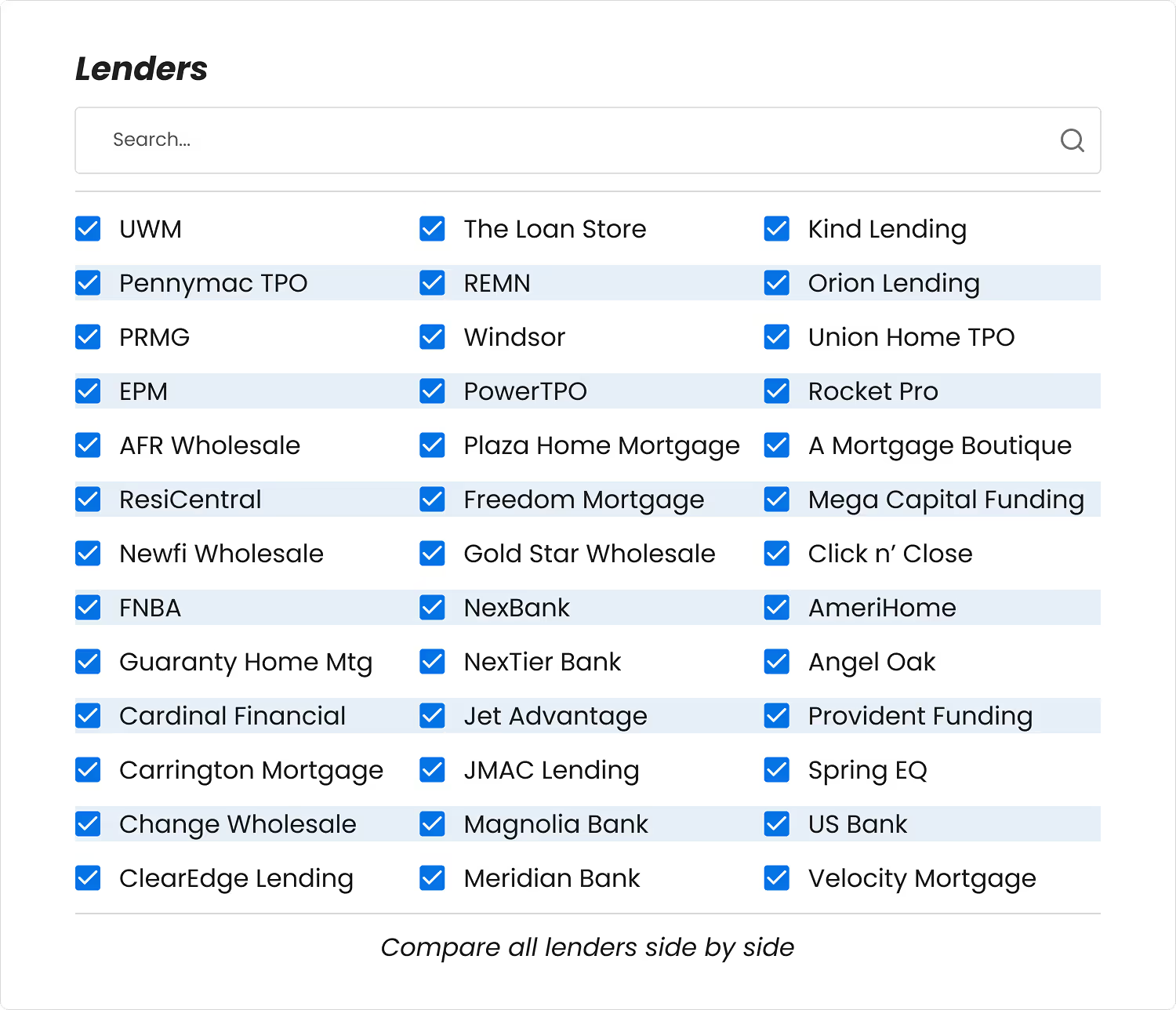

Access a marketplace of over 1,500 mortgage products from 30+ lenders with real-time pricing transparency. Our engine provides rate comparisons instantly, giving you the flexibility to find the perfect product for each client.